Our beautiful World

“over long-term, the world-wide economy depends on only two factors – population & productivity;

first is God given, and second is human driven, but for short-term, it runs on availability of credit, driven by central bankers acting on behalf of politicians – the demigods” ~ TheVIP

Human behavior drives the economy …

most human are NOT creatures of logic, rather creatures of emotions … we do what makes us feels good and not necessarily right for us

this simple, but not simplistic video by Ray Dalio, a billionaire, hedge fund manager and founder of Bridgewater Associates, shows the basic driving forces behind the economy, and explains why economic cycles occur by breaking down concepts such as credit, interest rates, leveraging and deleveraging.

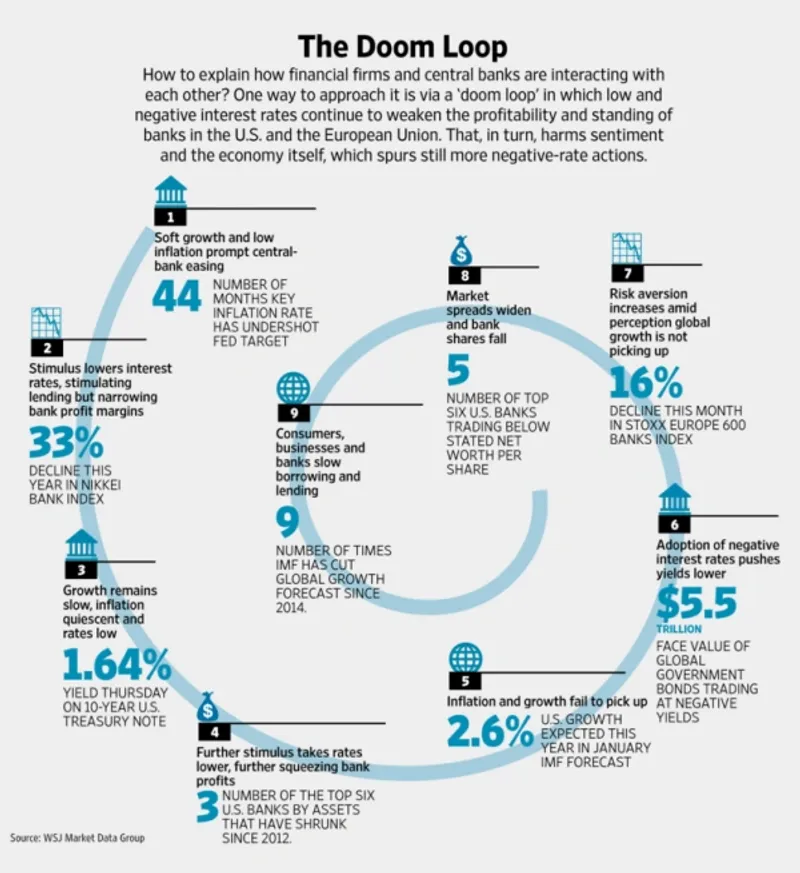

let’s talk about negative rates happening around the world [June 2016]

“Global yields lowest in 500 years of recorded history. $10 trillion of neg. rate bonds. This is a supernova that will explode one day.” – Bill Gross … e.g. the British government just issued its lowest-yielding bonds since 1694 … Goldman Sachs recently calculated that a mere 1% rise in US Treasury yields would trigger over $1 trillion in losses, exceeding all the losses from the last crisis.

if you follow my blog, i predicted negative interest rates in Dec 2014 … anyway, the question is what does it mean to you and your money … and the short answer is .. bad .. very bad ..!

let’s step back in time … USA has been following the Keynesian economics for a long time, which in nut shell means that monetary policy can provide a boost to economy temporarily … the key word is temporarily .. but it is human nature to ignore this word so, whatever works temporarily (i.e. short-term), should also work for sustainable period (i.e. long term).

interestingly, this conundrum (ignoring temporary nature of a concept and extending & using it for sustainable period) is followed by governments, corporations, and in families … almost everywhere in this world, where people and politics are in action.

second, since early 1980s, US economy has been growing steadily and a huge % of the growth is caused by easing monetary policy and easy availability of credit (think credit cards, junk bonds, derivatives etc.) … the federal funds rates in US have come down from high teens to low single digit in 2007 … it’s all good.

so, in 2008 when the financial crisis hit USA, feds opened their book and quickly lowered the rates and ultimately taking them to zero … which provided boost to an almost dead economy and saved us going into depression … so far so good … US economy survived and the stock market thrived.

however, as the US economy started breathing [in 2010], Europe was faced with Greece debt issue, followed by Spain … then Italy and Portugal and so forth … the 2008 financial crisis was a world-wide issue, not just US, although the effects showed up in different parts of the world at different times … anyway, as Europe faced similar issues that we did, they simply followed our policies (why not … beg, borrow or steal !) … if it worked in US, it should work in Europe too .. right ..? … so, our friends in Europe not only copied US monetary policy, but then extended them one step further … they took their rate to zero, and extended them further into negative territory … stock markets first loved it (as of late 2016), until they faced the reality that banks profits are sucking … banks don’t make money in lending in negative interest rates .. is it so high-tech to understand ..! … if banks don’t make enough money, which are 20-30% of any economy, how can you justify the high market values, and as a result, markets world-wide have hard time uplifting themselves … this is pretty much what is happening since the beginning of 2016, although it is just the tip of the iceberg.

the moral of the story is that we should have been off the low interest rates definitely by now (as in 2016) … actually as of 2013 in my view, and we should be thinking about going into positive side, as the rates have been low for 7+ years … rather, the people want them to keep them at this level forever since it has worked for so long, why change now (short-term becomes long-term) … have you not seen this movie before at your place of work … and a step further, taking them into negative territory … a really bad idea ..!

let’s take a consumer’s view into negative rates (in early 2016) … in last half century, whenever central banks around the world lowered the rates or provided additional credit to boost their economies … it worked, and worked well for 50 or so years, which is a long time … however, we are at a point when easing monetary policy or providing additional credit is no longer boosting the economy .. there is so much over capacity world-wide including oil, there seems no inflation in near future even with so much money floating around … and the consumer is getting sick, even though the money is free, saying “i have already bought whatever i wanted to … i have a house at a 4% mortgage … a car at 2% …

cash/credit @ 0% … so, i can’t spend anymore… plus, i am not getting any raise from my employer lately (no wage inflation)” … hence i am taking this money back to the bank, and now bank says that if you bring the money back to me, i am going to charge you … hence negative interest rates … and the poor consumer is in tears … on the other side, if consumer is not ready to borrow from the bank. .. bank can’t make money … long-term rates still going down … there is so much of cash floating around in the world that it has no value … long story and without a happy ending.

think about it … पिक्चर अभी बाकी है मेरे दोस्त

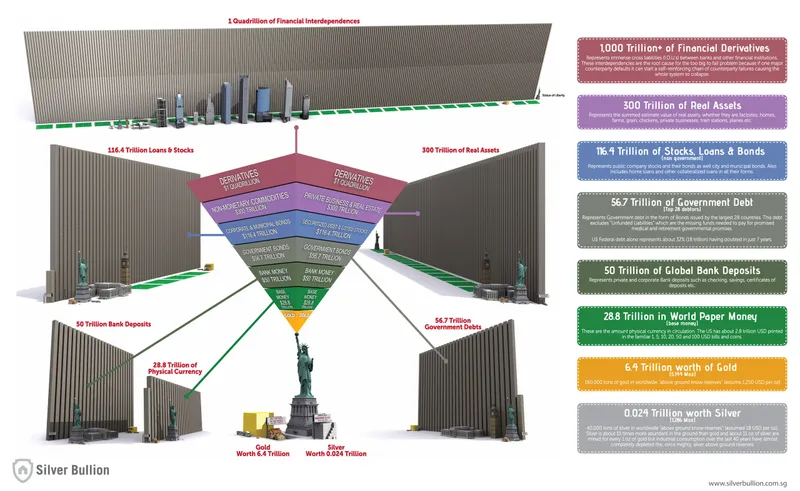

the financial world we live in [May 2016]

the world-wide financial system – a house of cards [Feb 2015]

in the picture on the right, depicting the world-wide financial system, the most interesting layer is at the bottom [of this inverted pyramid], made of financial derivatives … although, each layer has brought a new level of prosperity to the mankind, but they have made the financial system more delicate & sophisticated, and therefore, requires handling with much more care … we can learn from past screw-ups but the future ones will be nothing like past.

interestingly, the derivatives layer, the latest, happens to be younger than me, while gold & silver are couple of thousands years old … and everything else is in between the two time frames … the gold & silver layer is few trillion dollars (real value based on current production costs and supply & demand) while the derivatives are of a quadrillion dollar (15 zeros, nice!) notional value (not real!) … scary, thrilling, excitement & fun (some call them as risks & rewards)

world map based on individual country’s stock market valuations (IN Billions, 2015)

look for Russia, Africa & South American countries in this map – largest resource intensive locations

World population growth is declining .. & the GDP Growth is slowing … especially in developed countries … Japan is not an exception … the other countries may be experiencing the same in near future.

a solution to this problem is to entice & steal workers from other countries – also known as immigration.